The New Financial Reform Bill Has the Banks Crying All the Way to the …. Bank

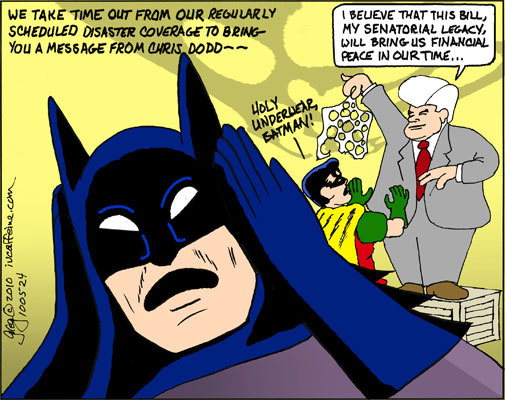

The disaster bubbling up to the surface down in the Gulf is assuming proportions that make the plagues of Egypt look like a teen party that got a little out of control. “Don’t worry. Accidents Happen!” says the new bright star of the Tea Party Brigade, Rand Paul, “it’s un-American to blame BP for being negligent.” After all, there were THREE companies that were negligent down there and one of them was that shining example of patriotic profit-taking, Halliburton! You can’t blame BP for an Act of GOD! Well, I have a question. If these god-fearing jackasses think the destruction of the Gulf of Mexico and the Mississippi Delta is an Act of God, then WTF do they think God is trying to SAY???But I digress. My real topic is that other corporate disaster, the Financial Reform Bill. Yup, Chris Dodd has finally achieved his valedictory legislation, a financial reform that is in every way the counterpart of the Health Care and Credit Card Reforms. Like underwear that is so full of holes, the skidmarks get on your pants anyway. Yes, there are some nice new picket fences with signs that say, “Don’t Go Here Or We’ll Slap You,” in place, but by and large, “too big to fail,” has become enshrined by law as the WAY THINGS ARE in the United Corporations of America.

Limiting the size of banks? Perish the thought–just like the US itself is too big to fail, our banks are too big to close. Breaking up some of the companies that were responsible for a worldwide economic collapse? You gotta break some eggs to make an omelet! Caps on credit card interest? We covered THAT back with credit card reform! And what a success THAT has been. And the piece de resistance? The wall between trading and commercial banking that would prevent banks from using our money to buy chips in their own casino? Hahaha you must be joking.

OK there’s a new consumer agency that Elizabeth Warren, darling of the Daily Show, has been pushing. And there’s some new regulation and oversight. But mostly Wall Street is left with the task of policing Wall Street and us chickens know what it means when the fox is guarding the hen house. The Street will still hire its own credit raters, you know, the ones who gave those risky investments AAA ratings? And derivatives will still be sold to hedge risk, thereby allowing risk to be swallowed up in bookkeeping. So in every way, the things that led to the economic collapse of 2009 has been left in place. Anyone want to take bets on another collapse by 2016? How about 2012?

If this is Chris Dodd’s valedictory achievement in the Senate, I’d say his retirement is a very good thing for the American people. But–couldn’t you have left a little quicker, Chris?

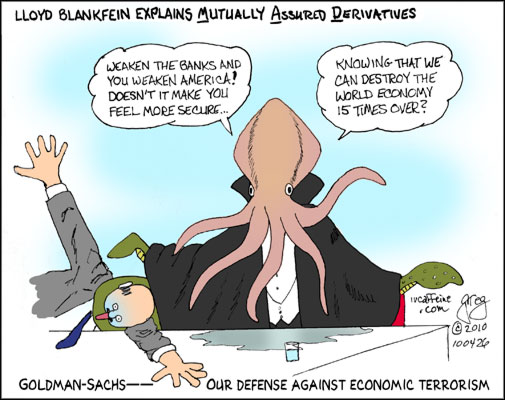

Goldman Sachs–shorting America

Oh, how I wish I’d come up with Matt Taibbi’s description of Goldman Sachs as a “great vampire squid wrapped around the face of humanity.” A prescient lad, he said that even before the revelations this past week about “The Big Short”. Seems these very shrewd operators basically: 1) made a bunch of loans to people they knew had a very good chance of defaulting; 2) bundled them into a security that they noodged Moody’s and Standard and Poors to rate AAA; 3) sold them to unsuspecting investors as a solid investment; and 4) shorted them so that when the price fell, they’d clean up. In fact, the only way they could have lost money would have been for the loans to be repaid. Thus they not only screwed the poor schmucks who couldn’t repay loans (remember the sliding rates that went up after a few years? Let’s stack the deck while we’re at it.) But they screwed their clients.And when the bottom fell out, they screwed everybody. Lloyd Blankfein–who has an eerie resemblance to Erich von Stroheim, the “Man You Love To Hate”–claims he was doing God’s work, but for the life of me, Blankfein’s God has little to do with any modern God I know–more like Cthulhu (and we’re back to great vampire squids). Senator Dodd from Arkham has heard the call of Cthulhu and has busily crafted a financial reform bill that keeps the monsters and their derivatives intact–it seems mostly concerned with restoring the power of the regulators to wank instead of work and watch internet porn. Not break up the banks that bet AGAINST AMERICANS.

Most recently, Blankfein has had the gall to tell us that if we break up the banks, we will weaken America. Like the worst economic crisis since Black Friday didn’t do that already. Maybe he meant it in relative terms. After all, they broke the economy of the entire world–maybe America would have come out ahead on the deal.

If we’d shorted it.

AIG: Are you SURE this was the first you knew about bonuses, Mr. Geithner?

Well, this HAS been an interesting week. The news about the AIG bonuses broke late Saturday, early Sunday. The liberal bloggers picked up on it immediately, but the conservative bloggers didn’t touch it until Tuesday. Evidently, they don’t read the liberal blogs and had to wait for someone else to digest it and hand them a party line. The moderates joined in and there was a firestorm of protest, best summed up by Chuck Grassley as a general demand for resignations or hara-kiri. Personally, I’d like someone to leave a gun on their desks and tell them to “do the right thing,” but what can I say, I’m an anglophile. Obama said he hadn’t heard about the bonuses until a few days before the s**t hit the fan. Tim Geithner said he’d only heard a few days before that. HOWEVER, Ron Wyden revealed that when the bailout bill passed the Senate, there was a strong provision putting caps on executive bonuses for companies being bailed out. It wasn’t there when it hit the House. As Rita Rudner once put it, where did the glue go? Treasury tries to put the blame on Chris Dodd, claiming he added a clause granting exemptions for bonus agreements already in place. But what REALLY happened, as Jane Hamsher has documented is that Dodd et al had inserted a provision placing caps retroactively on executive compensation…and Treasury Secretary Timothy Geithner and Lawrence Summers, head of the National Economic Council, put pressure on Dodd to remove or seriously weaken this provision. And Senator Dodd pointed the finger straight back at Geithners–who, you will remember claimed like Sergeant Schultz, “I knew nuzzing, NUZZING!” Obama then said, in one of his less-than-sterling statements, that the administration will use every legal means to try to recoup these bonuses–which have already been paid. Well, hell, Barack, did you think we expected you to use ILLEGAL means?

Obama’s appointment of Tim Geithner to head the Treasury was an iffy deal to begin with. The charismatic young president’s strong points do not include economics and Geithner’s appointment seemed an attempt to look like he was putting one of the adults in charge. After all, a banker should know about banking, right? It also looked like a safe place to put an opposing viewpoint. Well, Mr. Geithner has just demonstrated that his loyalties run with the banking community, not with the people of the US, and his appointment, far from placing one of the adults in charge, actually was putting one of the foxes in charge of the henhouse. It is time for Mr. Obama to reconsider this appointment. No, screw that, it’s time to ask for Timmy’s resignation. Geithner was going to follow a timid course, the tried-and-true, which in this situation is neither tried nor true. Let’s get someone like Paul Krugman in place so we can get an economic policy with balls, not cronyism.

Oh and AIG has decided on a new strategy to save the company. It’s changing its name…

Check out

BTW I think Timmy Geithner makes an excellent Brigid O’Shaunessy–he’s about as honest, dontcha think?

![[del.icio.us]](http://ivcaffeine.com/wp-content/plugins/bookmarkify/delicious.png)

![[Digg]](http://ivcaffeine.com/wp-content/plugins/bookmarkify/digg.png)

![[Facebook]](http://ivcaffeine.com/wp-content/plugins/bookmarkify/facebook.png)

![[Mixx]](http://ivcaffeine.com/wp-content/plugins/bookmarkify/mixx.png)

![[Reddit]](http://ivcaffeine.com/wp-content/plugins/bookmarkify/reddit.png)

![[StumbleUpon]](http://ivcaffeine.com/wp-content/plugins/bookmarkify/stumbleupon.png)

![[Technorati]](http://ivcaffeine.com/wp-content/plugins/bookmarkify/technorati.png)

![[Twitter]](http://ivcaffeine.com/wp-content/plugins/bookmarkify/twitter.png)

![[Buzz]](http://ivcaffeine.com/wp-content/plugins/bookmarkify/yahoobuzz.png)

![[Email]](http://ivcaffeine.com/wp-content/plugins/bookmarkify/email.png)

gallery:

gallery: GregoriusU @ Deviant Art

GregoriusU @ Deviant Art