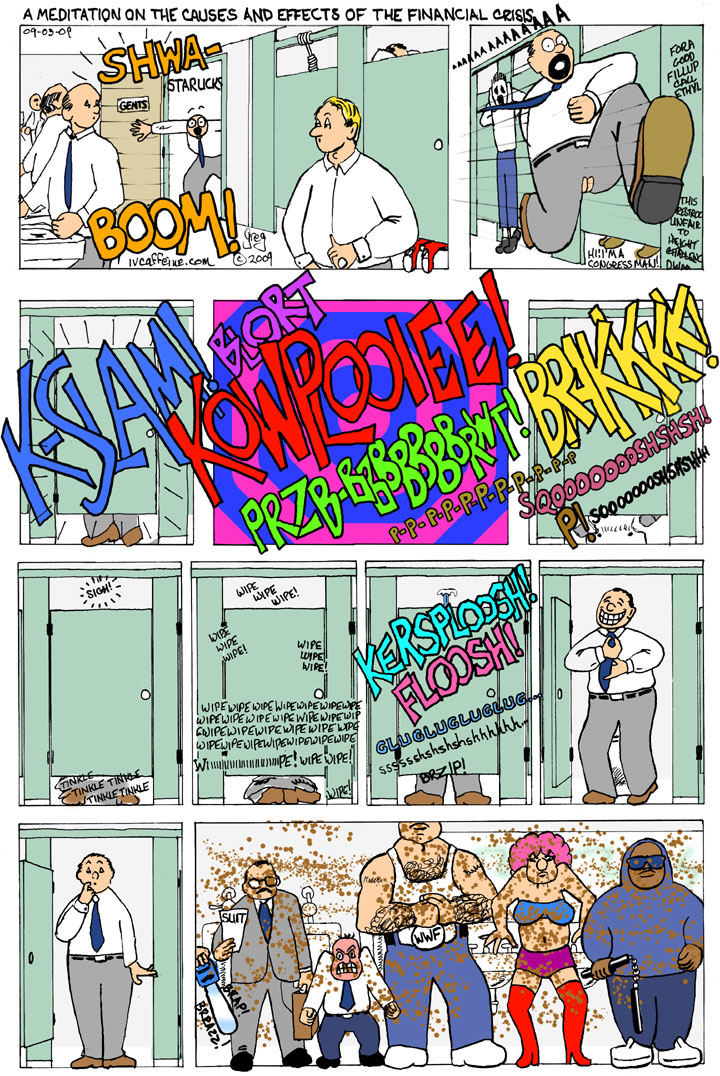

The Financial Crisis’s Effects on the Rest of Us

The Big Dither by Paul Krugman in March 5 NYTimes tells us how the administration keeps trying to foist the cost of the toxic waste of the financial crisis on the taxpayer, essentially rewarding those who created it. Today’s cartoon illustrates that idea in a more straightforward manner.

You see, the problem is that all these financial institutions in trouble have what are known as “troubled assets”. What’s a troubled asset you ask? Why, it’s a loan you wouldn’t have made in the first place if you’d been in your right mind. And we know that everyone in the financial sector was crazy with greed–more than usual that is. It had something to do with not having any playground supervisor. Basically, it meant that they made loans that couldn’t be paid back, either because the risk factor was too great or the loan’s interest ballooned beyond the capacity of the debtor to pay it back. At the time, these loans were considered assets–they were designed to be easily be made, so the assets seemed to be going up and up and up. But like many balloons, they were just hot air. Bernanke at the Fed and Geithner at Treasury are sure that these worthless pieces of paper are really worth something, if only they could get someone stupid enough to buy them, and it they were sold, this would get the idiot banks who made the loans out of trouble. But nobody’s biting. Mainly because that would be throwing money into a deep well and then covering it over. So the plan is to get Uncle Moneybags to prop up the loans, by loaning money to the buyers, loans that would not have to be repaid if the troubled asset defaulted. Which it probably will. Which means that Uncle Moneybags foots the bill for these toxic loans, getting the naughty bankers out of trouble with no permanent ill effects from their bad behavior, the US taxpayer foots the bill and we wind up even further in debt to China.

I have a modest proposal. Let’s offer a deal to Bernie Madoff. He can reduce his time and fines (when and if he’s prosecuted) by selling off these loans. If ANYONE can do it, Bernie can. The only proviso is that he will NOT be allowed to sell them to anyone in the US. We can foot the bill to send him to China.

It’s a better idea than anyone else has come up with 🙂

R Allen Stanford wants to help you in the worst way…

One of the dogmas of neocon economics is that any kind of governmental regulation or oversight is bad because it prevents business from meeting its true potential. That’s not quite true. What it does is prevent businessmen from having as much fun as they want playing with the markets and becoming Masters of the Universe. In other words, fraud…

I can understand this reluctance to allow governmental interference. I too was enamored of the schemes of Fisk and Gould in the 19th Century. What a pair…how they ran off Erie Railroad stock on their own printing press to sell to Commodore Vanderbilt and skipped across the Hudson on the Ferry moments ahead of the police. Or how they cornered the gold market and caused a massive panic. As James Fisk said when people complained about losing entire fortunes: “Can’t a couple of guys just have some fun?” I’m sure they were whom Ronald Reagan had in mind when he began the march towards totally free-wheeling markets.

Of course, there is a downside. With no regulation, you get people like Bernie Madoff (Weekend at Bernie’s $50bn), R. Allen Stanford, given the title Sir by Antigua for his role in its economic boom, soon to evaporate with the worthless CDs he sold, and that DOPE stock trader who tried to fake his own suicide by crashing a plane without even taking care to load a dead body into it. No one’s seen Sir Stanford lately–he tried to skip town by chartering a plane, but the credit card company had already axed his card–presumably, he went home to pick up some spare krugerands so he could rent one for cash. Of course, all these shenanigans take place in a rarefied region where people HAVE a few millions that they can lose. But, I ask you, who’s gonna pay for it? Three guesses, and I bet you guess it on the first try…

![[del.icio.us]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/delicious.png)

![[Digg]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/digg.png)

![[Facebook]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/facebook.png)

![[Mixx]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/mixx.png)

![[Reddit]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/reddit.png)

![[StumbleUpon]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/stumbleupon.png)

![[Technorati]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/technorati.png)

![[Twitter]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/twitter.png)

![[Buzz]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/yahoobuzz.png)

![[Email]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/email.png)

gallery:

gallery: GregoriusU @ Deviant Art

GregoriusU @ Deviant Art