Returning from the turkey to get the bird

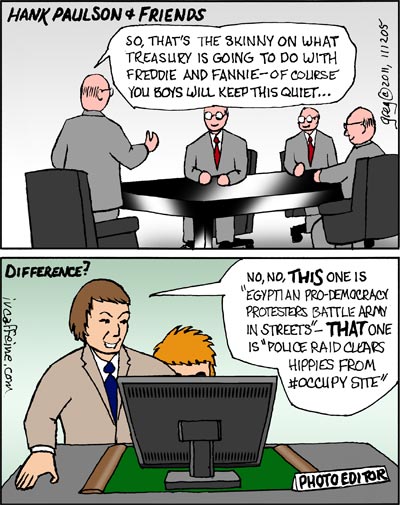

So, after finally having digested ALL of the Thanksgiving turkey, we turn once again to a much less edible bird. Earlier this week, we found out that Henry Paulson–you know, former CEO of Vampire-Squid–while he was Secretary of the Treasury–wandered into a meeting with hedge fund managers and told them what Treasury was going to do about Fannie Mae and Freddie Mac. SAY WHAT? Umm, Hank, that was supposed to be a secret until it happened! Did it not occur to you that someone might possibly engage in some insider trading on the basis of WHAT YOU #$%^&* JUST TOLD THEM? Oh, but these are my buddies–they’d never do anything so illegal, unethical and immoral. Well, most of them anyway.There we have it, the essence of what ^&*(#$%^& went wrong with our system. We used to think that the Grant and Harding administrations were the poster children for corruption. Well, Bush II certainly gave them a run for their money (so to speak) and the Obama administration is coming up fast along the far turn. Here, pack of foxes, please take care of the hen house–we know that ace chicken stealers are going to be the best as keeping predators away! Other predators, that is!

With that shocking bit of news, did it really come as any surprise when we found out the REAL scale of the bailout? That the Fed SECRETLY loaned banks 7.7 TRILLION DOLLARS at interest rates even lower than they pay their mom and pop customers on bank deposits? And that these banks loaned it back to the government to make a profit on it? Not to worry, they only realized 0.17% profit on it. Right–only 13 BILLION dollars.

And while we found all this out, the cops of various cities have been coordinating attacks on those dirty hippies, rapists, thieves and murderers, as Fox and Friends would have it, at the same time as the Egyptian military has been attacking “pro-democracy demonstrators” in Cairo. You’ve seen the pictures…can you tell the difference? YES–tanks! You’re welcome!

This has gotten the reactionary forces in Congress to get the knickers in a knot. Hey–if the Egyptians can use tanks against their own citizens, WHY CAN’T WE? Why not indeed! So they included in the Defense Authorization bill language authorizing the military to detain terrorist suspects on native soil. Now a lot of people have gotten upset that American citizens might be incarcerated by the military, thrown in some brig and held indefinitely, but let’s ask another question. If the military can go after terrorists–how’s it going to get them? Are Navy SEALS going to be attacking terrorist cells run by my next-door neighbor? What happens if it’s decided that the attack might be too dangerous? Is that a drone I see flying THROUGH MY LIVING ROOM?

Now you might think that this is just paranoia, but consider this: 60 senators thought that this was a $%^&*#$ GOOD IDEA. It was originally 61, but one of them decided it really looked bad. President Obama has threatened a veto. That would make this his 3rd–an average of one a year–tied with Herbert Hoover. You know, the guy who let the banks tell him what to do during the Great Depression.

Why does that give me a headache?

The Financial Crisis’s Effects on the Rest of Us

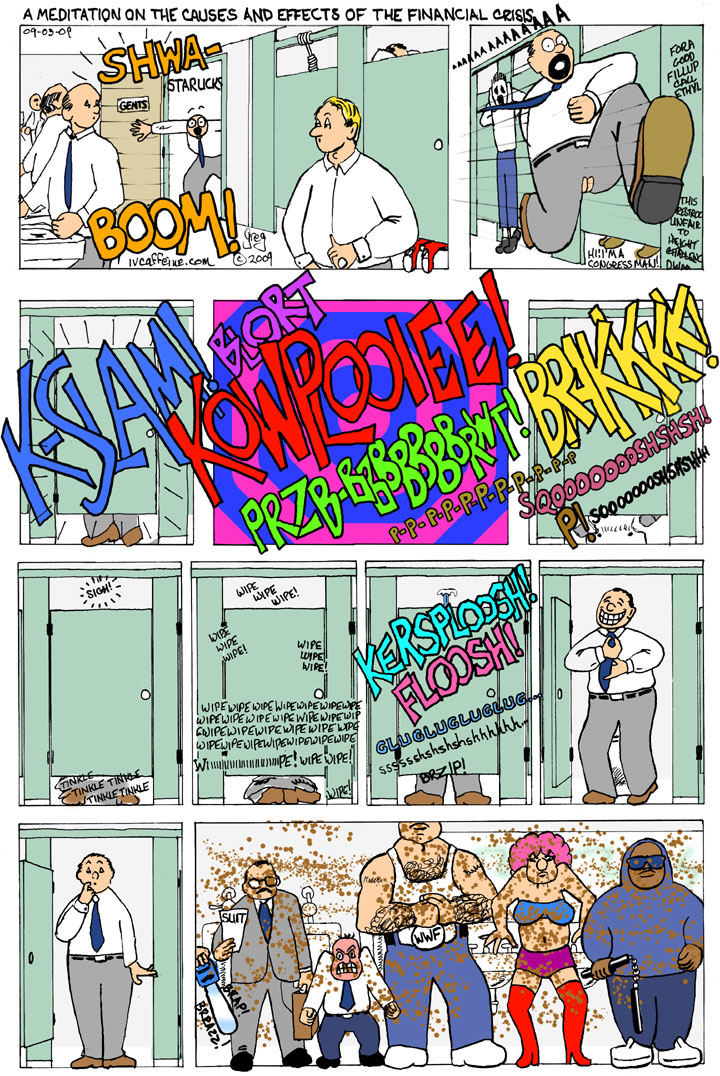

The Big Dither by Paul Krugman in March 5 NYTimes tells us how the administration keeps trying to foist the cost of the toxic waste of the financial crisis on the taxpayer, essentially rewarding those who created it. Today’s cartoon illustrates that idea in a more straightforward manner.

You see, the problem is that all these financial institutions in trouble have what are known as “troubled assets”. What’s a troubled asset you ask? Why, it’s a loan you wouldn’t have made in the first place if you’d been in your right mind. And we know that everyone in the financial sector was crazy with greed–more than usual that is. It had something to do with not having any playground supervisor. Basically, it meant that they made loans that couldn’t be paid back, either because the risk factor was too great or the loan’s interest ballooned beyond the capacity of the debtor to pay it back. At the time, these loans were considered assets–they were designed to be easily be made, so the assets seemed to be going up and up and up. But like many balloons, they were just hot air. Bernanke at the Fed and Geithner at Treasury are sure that these worthless pieces of paper are really worth something, if only they could get someone stupid enough to buy them, and it they were sold, this would get the idiot banks who made the loans out of trouble. But nobody’s biting. Mainly because that would be throwing money into a deep well and then covering it over. So the plan is to get Uncle Moneybags to prop up the loans, by loaning money to the buyers, loans that would not have to be repaid if the troubled asset defaulted. Which it probably will. Which means that Uncle Moneybags foots the bill for these toxic loans, getting the naughty bankers out of trouble with no permanent ill effects from their bad behavior, the US taxpayer foots the bill and we wind up even further in debt to China.

I have a modest proposal. Let’s offer a deal to Bernie Madoff. He can reduce his time and fines (when and if he’s prosecuted) by selling off these loans. If ANYONE can do it, Bernie can. The only proviso is that he will NOT be allowed to sell them to anyone in the US. We can foot the bill to send him to China.

It’s a better idea than anyone else has come up with 🙂

![[del.icio.us]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/delicious.png)

![[Digg]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/digg.png)

![[Facebook]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/facebook.png)

![[Mixx]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/mixx.png)

![[Reddit]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/reddit.png)

![[StumbleUpon]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/stumbleupon.png)

![[Technorati]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/technorati.png)

![[Twitter]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/twitter.png)

![[Buzz]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/yahoobuzz.png)

![[Email]](https://ivcaffeine.com/wp-content/plugins/bookmarkify/email.png)

gallery:

gallery: GregoriusU @ Deviant Art

GregoriusU @ Deviant Art